FHA funds basically cost a lower amount if you have the lowest in order to mediocre credit history otherwise a little deposit. Antique funds constantly exercise better if you’ve got a premier credit rating and a huge downpayment. To display it, we’re going to examine two conditions and see simply how much FHA vs. traditional fund would pricing in the each one of these.

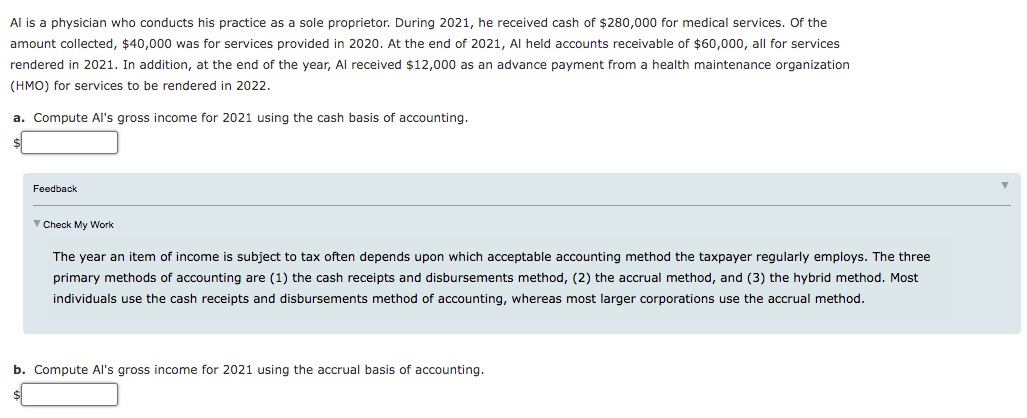

What if you will be to get a good $500,000 home with an excellent 5% advance payment regarding $twenty five,000. You have got an effective 640 FICO Get. Your own 30-season mortgage options are a keen FHA financing which have an excellent 6.8% interest rate otherwise a traditional loan that have good seven% interest. Here’s how their will set you back do examine:

The brand new FHA financing ‘s the obvious champ right here. It has got all the way down monthly obligations, straight down upfront will cost you, and you will saves you almost $twelve,000 complete.

However, what if you may be to shop for that same $500,000 domestic, except this time around, you may have an excellent 20% down payment away from $100,000. Plus FICO Score is actually 760. Therefore – you may get a 30-12 months FHA financing with a 5.8% interest or a thirty-seasons conventional mortgage which have an excellent 6% interest. Consider exactly how loan costs evaluate now:

In this case, you happen to be best out-of which have a conventional mortgage. Costs are lower across-the-board, and you cut more than $20,000 full.

FHA financing generally have lower monthly obligations, but large upfront can cost you than just conventional financing. In the event the rates is actually equal, conventional finance are generally cheaper over a 30-seasons name. If you should get a keen FHA otherwise conventional mortgage hinges on your needs and you may what you are able be eligible for.

Individual Home loan Insurance coverage: Traditional Loans

Individual mortgage insurance policies (PMI) try an insurance policy towards a traditional mortgage set up of the the lending company and taken care of by borrower. They handles the borrowed funds financial should your resident non-payments.

Lenders constantly need PMI if you make a downpayment reduced than just 20% having a timeless home loan. For individuals who set-out payday loan Golden an inferior down-payment, the lender must fund more of the household pick, making it much harder to recover its will cost you for those who default.

Can you imagine your make an application for a home loan to possess an effective $five-hundred,000 house. If one makes an excellent 20% advance payment regarding $100,000, the lending company cash the remainder $eight hundred,000. From inside the a worst-instance situation the place you default, the lender is also repossess market the home. Because it financed 80% of one’s income rate, it really stands a good chance from the recovering exactly what it’s due.

Now consider you put down step 3%. Which is just $15,000, and so the lender should fund $485,000. The lending company possess significantly more exposure, as if your default and home prices shed, they I policy that can cover the lender.

PMI Costs With a traditional Financing

The expense of PMI will be based upon the borrowed funds matter and you will generally speaking ranges from 0.25% to help you 2% per year, based on your credit rating. For those who have a top credit score, you can easily qualify for all the way down PMI costs.

Your deposit also has an effect on the expense of PMI, which is according to the loan matter. That have more substantial down-payment, you don’t need to acquire as much, and you may reduce PMI.

For example, let’s say you might be to order a beneficial $five hundred,000 household. For folks who lay out good 5% down-payment off $25,000 and get a loan amount regarding $475,000, PMI will likely pricing $1, to help you $nine,five-hundred per year, according to your credit. If one makes a good 10% down-payment from $50,000 and you may financing $450,000, PMI might pricing $step one,125 in order to $9,000 a-year.

Attained this new midpoint of one’s mortgage’s amortization agenda. When you have a thirty-year home loan, the latest midpoint is actually fifteen years. When you yourself have good fifteen-12 months home loan, this new midpoint was 7.five years.