Becoming economically match, it is very important see all the information of the obligations. Regardless if it feels overwhelming, force yourself to deal with your debts at once. Generate a summary of any expenses, including wide variety and you can interest rates. This can leave you an authentic image of in which something remain.

When you take note of the debt, take steps to pay it well. Discover more about the newest snowball and avalanche remedies for figure out which personal debt prevention strategy work best for you.

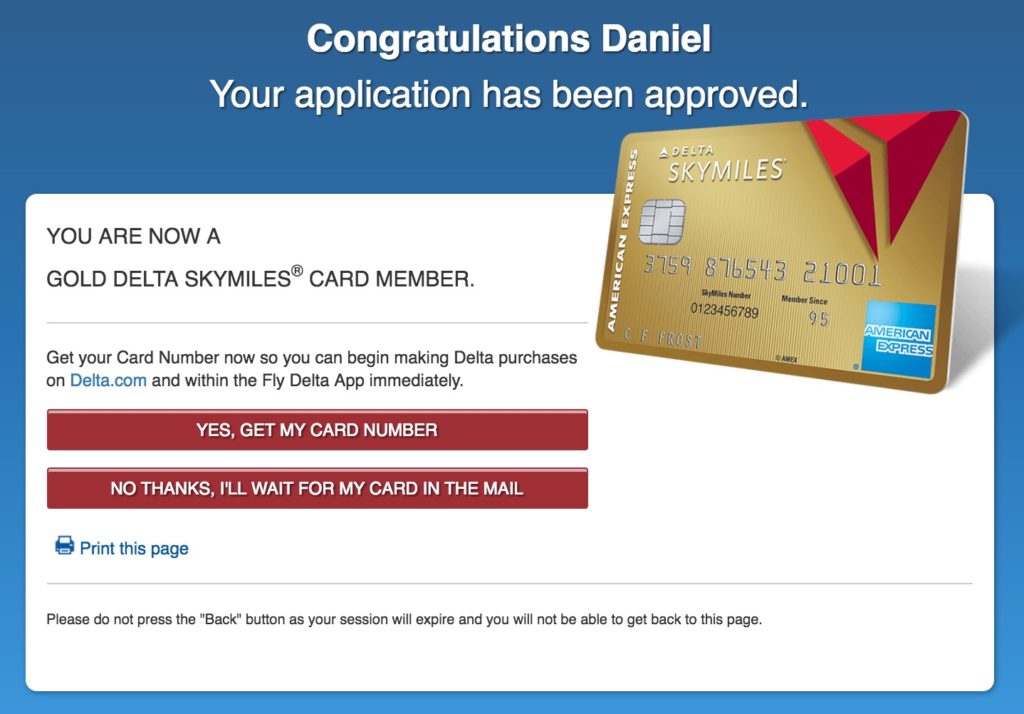

Because the you are considering a method to reduce personal debt, thought moving large-appeal mastercard and you can loan balances to some other card having less rates. Transfers of balance are really easy to over, also. Really creditors bring harmony transfer inspections otherwise enables you to transfer your balance due to a simple process on the web.

Balance transfers shall be an excellent services while unable to pay-off your own money https://cashadvancecompass.com/loans/loans-for-surgery/ or personal credit card debt, or if highest interest levels was staying you against and come up with much away from a damage on the overall balance

Since you think a balance transfer, watch for fees that will consume aside at the deals. Plus, seriously consider precisely what the rate of interest might be towards the the debt immediately following any unique basic offers discovered.

For those who own your house, you may be in a position to re-finance their home loan to minimize their interest rate, slashed costs, or tap into home equity. If you’re not yes from the refinancing, listed below are some the help guide to house re-finance selection and possess assist deciding should you re-finance your mortgage.

You’ll want to make certain that you will be working with a loan provider just who could offer a diminished price. Before you re-finance, you’ll want to check out the adopting the affairs, on top of other things: one early rewards charges out of your latest financial; your current payment and you will exactly what it was that have an excellent the brand new loan; and position of the credit, that may perception your ability as recognized to own a different financing. For people who still have issues, get hold of your possible financial to rating let determining when it is a great flow for your requirements.

Whether you are considered a summer vacation otherwise hoping to end supposed for the loans for the second holidays, you will want to introduce an alternate savings account for these intentions. Setting aside small amounts of currency at a time will help your end billing this type of expenses down the road.

Whether you’re looking to re-finance financing otherwise arranged a good unique deals express, e mail us today to learn more about how the products and characteristics helps you be more economically fit. So if you’re seeking to clean through to debt studies, check out our very own WalletWorks page to own content, movies, and you can ideas on sets from building their borrowing from the bank to securing yourself out-of ripoff.

*PSECU isnt a credit reporting company. People have to have PSECU checking otherwise a PSECU mortgage is entitled to this service. Combined residents commonly qualified.

The content provided contained in this guide is for educational objectives only. Nothing mentioned is going to be construed due to the fact economic otherwise legal services. Certain products not supplied by PSECU. PSECU will not recommend any businesses, along with, yet not limited to, referenced some body, enterprises, teams, situations, blogs, or other sites. PSECU cannot warrant any suggestions available with third parties. PSECU will not make sure the precision or completeness of your information available with third parties. PSECU advises you talk with an experienced monetary, income tax, court, or any other top-notch when you yourself have issues.

Show that it:

- Simply click so you can email address a relationship to a friend (Reveals during the the fresh screen)