Economist Stan Liebowitz produces that Fannie mae Basis singled-out Countrywide Financial once the a «paragon» from an excellent nondiscriminatory financial just who works with people activists, pursuing the «more versatile underwriting conditions let

Nationwide Advantage Administration Company takes care of the purchase and you will spirits off loans away from third parties and you may finance started of the Countrywide Home loans toward behalf off Countrywide Lenders. They truly are outstanding or else illiquid domestic mortgage loans, which have primarily got its start less than Federal Homes Management (FHA) and Experts Government (VA) apps. The company tries to rehabilitate the fresh new financing, utilizing the upkeep businesses away from Nationwide Lenders, to securitize those people financing you to definitely feel eligible for securitization. The rest fund is maintained due to foreclosure and you may liquidation, and meeting authorities insurance coverage and ensure proceeds per defaulted FHA and you will Va program money.

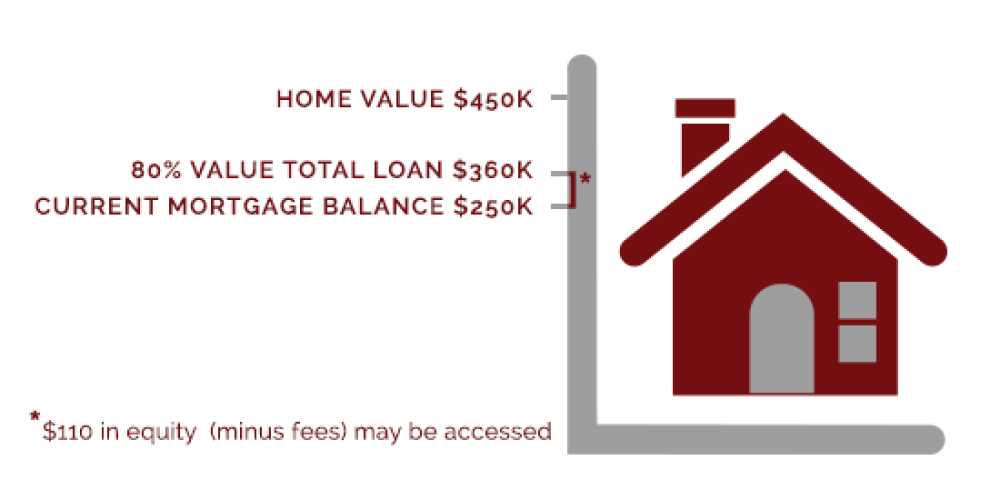

Balboa Reinsurance Team will bring a great mezzanine covering from reinsurance visibility having loss anywhere between minimum and you can restrict given amounts to your insurance agencies giving individual mortgage insurance (PMI) towards the loans read what he said within the maintenance profile. It provides this exposure towards substantially every financing in their portfolio that will be protected by PMI, which often is sold with most of the antique fund which have a unique loan amount more than 80% of the property’s appraised value. They produces a portion of the PMI premiums in return for taking so it coverage.

An important issues of one’s In the world Operations portion was International Household Funds (GHL): an effective Uk 3rd-team officer (TPA) shaped of a partnership between Countrywide and you may Woolwich plc inside 1998. Issues included Financing Control and you can subservicing, bringing home mortgage software operating, and mortgage loan subservicing in the united kingdom.

Because of the 2005, GHL procedure canned over 11.3 million ($20.step 3 mil) inside the funds, which was subserviced to own Barclays, PLC, the m&a companion. As of , Global’s subservicing portfolio was 59 million ($102 billion).

When you look at the , Barclays announced that it meant to cancel the next team administration plan having GHL and promote the loan originations and you will servicing functions into-house. It triggered Nationwide purchasing out Barclays’ leftover 29% risk within the GHL. Barclays introduced the fresh new process back in-family inside .

Subsequently Global’s presence in the uk has been confined in order to getting service in order to Barclays and you will Prudential Promise, just who continue using the latest exclusive originations, servicing and arrears control systems created to own GHL and Nationwide of the Countrywide Technology Classification (CWTG).

Countrywide offered to money having Nyc condition lawyer general Eliot Spitzer to pay black colored and you may Latina individuals defectively steered by Countrywide salespeople to higher-pricing funds. The company plus agreed to increase training and you may supervision of the financing officials and to spend Ny state $200,000 to cover will set you back of the data.

» The principle professional from Countrywide is alleged to possess bragged you to definitely to help you agree fraction apps, «loan providers experienced in order to extend the rules a while.» Countrywide’s dedication to lower-money financing got grown up to $600 million by early 2003.

The products it makes include Lender-Put Possessions and Automobile, which includes lender-placed automobile insurance and you may financial-put, real-assets risk insurance rates; Volunteer Residents and Automobile, which underwrites merchandising home insurance and house warranty plans getting people; and Existence and you can Credit, which underwrites term life, borrowing lives, and you can borrowing from the bank impairment insurance rates affairs

Specific consumers provides complained that whenever the fresh devastating hurricanes Katrina, Gustav and you can Rita, Nationwide informed financing people regarding affected areas which they you’ll capture a break for the payments without having any later costs, while the repayments could well be additional back again to the conclusion the mortgage. It now participate one to Countrywide pushed the mortgage consumers to spend the brand new missed money during the a lump sum, and later charge these were told they didn’t have to pay, within thirty day period otherwise deal with foreclosure.