- Updated FAO Procedure instructions to provide every procedures necessary to pursue principles

- Released books out of in-house payment package, DACC Base Grants, grant information On line search-engines & choice mortgage selection

Youngsters was render pointers concerning DACC Base grants, grant google for example FastWeb and you can motivated to look at the DACC Web page getting scholarship posts. Youngsters are available with suggestions regarding the DACC university fees payment package provided by NBS University fees Management Team. The files was verified into the accuracy of your FAFSA time aspects. For every single pupil completes the latest Institutional Confirmation Worksheet Means and you may submits it having supporting files highly relevant to new Honor 12 months before any commitment from eligibility getting software initiate.

This has been brand new staff’s feel that lots of students do not understand this concern neither respond to it safely. It is staff’s realization that a student must know the entire of the cost at the university and their funding information prior to making the newest determination a beneficial Stafford financing is necessary.

34 CFR Part (e)(1) of Government Family unit members Education loan System brings that a college can get won’t approve a great Stafford or Plus loan application otherwise get reduce the borrower’s commitment from requirement for the loan if the cause of that action was noted and you may offered to this new student in writing provided the fresh determination is generated on the a case-by-case foundation.

Session top priority handling (deadlines) is actually created about what history date students will get consult financing. Speaking of well had written and followed. There was an appeal strategy to target this type of work deadlines having extenuating situations.

A student which finishes the newest DACC Stafford Financing Demand Means (available with the Prize Page, in bulk from inside the School funding work environment lobby as well as on-line) and you can submits they into DACC FAO is assessed for qualifications for the system

When your college student have submitted the brand new Obtain a beneficial Stafford Mortgage means eligibility for a loan might be computed. Within the DACC Standard Management Package every requests for an effective Stafford financing was examined towards a case-by-situation foundation. The new Director can get demand a job interview to the scholar at the same time for the college student browsing entrance counseling. Students is actually notified written down when they maybe not entitled to a loan additionally the reason. In case the pupil is set eligible a letter doing the fresh entrance loan counseling session (in the event that relevant) additionally the mortgage Learn Promissory Mention (MPN). When guidance is accomplished new certification techniques begins and also at so it part the latest college student will be able to understand the Gross loan count since the awarded on their scholar support account.

The individuals need hold back until thirty day period pursuing the beginning of the brand new semester for loans as paid. Pupils exactly who request to charges books within DACC bookstore may do so without fee energized. The brand new university fees, charges and you can books try deducted in the mortgage net count and you can proceeds put-out towards the scholar. Next semester disbursement additionally require new 30 day discharge standards. Pupils was notified prior to the disbursement date to get pregnant this new disbursement. In the event that loan disburses this new college student will find so it Online financing amount on the monetary membership statement.

The DACC Financial aid group avoid the americash loans Crisman use of the fresh new FAFSA overall performance (the newest ISIR) to determine when the students commonly consult a beneficial Stafford Loan

A student may not have qualifications on the full Stafford Backed therefore the more Us-Backed Stafford from the maximum financing limits owed the latest DACC Prices out of Attendance (COA).

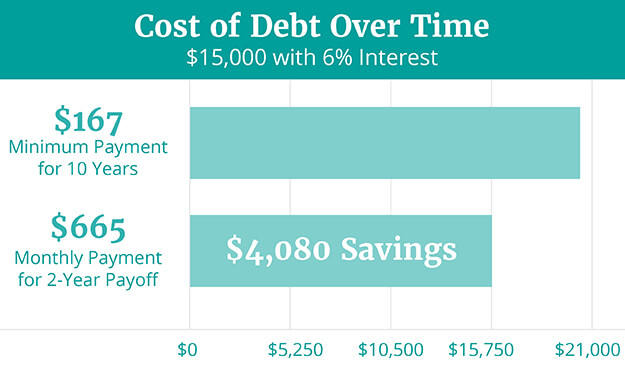

DACC cannot remind way too much credit and councils most of the college student to help you acquire at the minimums necessary to fulfill expenses (direct and you can indirect).