The web shopping giant’s hope to include «discounted» college loans compliment of another partnership with Wells Fargo elicits inquiries of user supporters on the you’ll be able to duping out-of students.

Into the Thursday, Craigs list and banking and monetary attributes business announced a partnership whereby Auction web sites Best Beginner members was eligible for an effective 0.5 fee part prevention on the interest getting individual beginner financing applied for courtesy Wells Fargo Studies Economic Properties.

We have been focused on advancement and you may meeting our people where they is — and you may even more that’s in the electronic room, John Rasmussen, Wells Fargos head regarding individual lending group, told you in the an announcement. This is a significant chance to assemble a few great brands. At the Craigs list and Wells Fargo, providing exceptional customer service and you can permitting customers are in the middle of everything i do.

Research «figuratively speaking» into Amazon and the overall performance are headings like the Student loan Scam and the Education loan Disorder: How good Motives Composed an effective Trillion-Buck Problem

New statement will come at a time when student loans are arriving below increasing scrutiny from political figures worried about university affordability and you will overindebtedness. It signals that even in the current political environment, retailers look for education loan individuals because profitable needs to own selling.

The offer try fulfilled is confronted with dismay because of the Institute to have University Access Achievement. Pauline Abernathy, this new communities executive vice president, said the partnership was created to dupe college students which qualify for low-notice government figuratively speaking into the taking out fully costly individual money which have less protections.

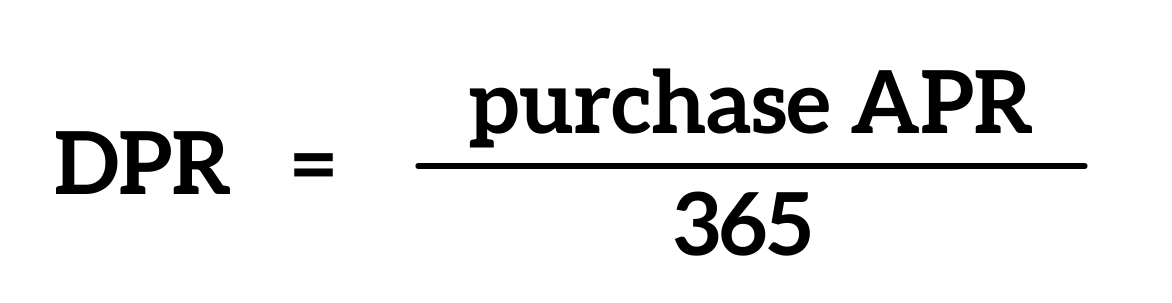

Private loans are among the riskiest a way to loans good college education, Abernathy told you. Particularly credit cards, he has got the greatest costs in the event you can minimum pay for him or her, however they are significantly more difficult to release in the personal bankruptcy than credit cards and other user costs.

Undergraduates with government Stafford funds will acquire at a consistent level out of just step 3.76 per cent this season. 03 percent for a variable interest rate loan otherwise % getting fixed-rate financing, depending on the companys website. Abernathy in addition to indicated so you’re able to terms and conditions on companys website proving that the financial set aside the legal right to tailor or discontinue attract speed offers any moment.

Alexander Holt, an insurance policy analyst in the think-tank The newest America, said that when you find yourself federal finance tend to be more glamorous, discover borrowing constraints to have student students which can still has unmet costs associated with gonna school. And even though the quantity of personal loans is growing, it however compensate simply a minority — eight.5 % — of your own student loan markets weighed against federal student education loans.

For those who nevertheless you prefer resource having college or university above the government college student loan limit, there is no problem that have taking right out a private student loan, Holt said.

But the guy requested as to the reasons Craigs list — a family hyperfocused into the brand profile and you may customer care — manage affiliate itself having personal student loans, a product or service having traditionally come a liability to own brand name reputations.

Amazon is actually bringing a beneficial reputational risk having an extremely lowest rewards, he said. It is a giant business. However it is maybe not grand and it is constantly run significant reputational risk into the companies with it.

Craigs list Finest users compensate more than half of all users on the website, centered on research create the 2009 month.

Draw Huelsman, an elderly policy analyst during the Demos, told you he would suggest students debtor to follow solutions due to government college loans more than a great deal so you’re able to shave their attention rates on the an exclusive financing that have a primary registration. However, of a wide direction, he told you the partnership between Wells Fargo in addition to on the internet retailer shows how normalized scholar loans has been.

Rates into https://cashadvancecompass.com/installment-loans-ca/san-diego Wells Fargo individual figuratively speaking can go since the high once the nine

There is an assumption that simply such college students will have in order to perhaps shop on line to have guides and provides and other content and you can Auction web sites Perfect is one way to accomplish this, theyre and additionally planning acquire college loans, the guy told you. Its a bit telling you to student loans otherwise student loan consumers was today a distinct segment business in themselves.