A group of graduates in shape treks as a consequence of Red-colored Square after a commencement at the School out-of Washington towards . (Paul Christian Gordon getting Crosscut)

As the authorities arguments education loan forgiveness and grows appeal pricing towards the future financing, the newest Washington Condition Legislature are going directly into generate borrowing from the bank to own college cheaper for students here.

Gov. Jay Inslee when you look at the March finalized Domestic Statement 1736, establishing a minimal-interest student loan system and make higher education a great deal more manageable for college students in the Arizona. County Associate. Pat Sullivan, D-Covington, just who backed the fresh new legislation, has pushed this notion in past times.

One of the primary frustrations that we read out of mothers are the cost of college or university, Sullivan said when you look at the an interview which have Crosscut, and you will from college students also.

The fresh new lawmaker has recommended a 1% threshold towards rates of interest to make it more comfortable for students since they move on to their next endeavors. HB 1736 introduced one another properties into the nearly a party range vote.

Brand new Arizona system finds a period when Democratic legislators during the the newest federal height was moving President Joe Biden ? whom paused education loan money for over forty-two billion People in the us ? so you can lose student loan bills to have individuals by $fifty,100000, a greater shape than simply Biden features conveyed he’d forgive. Predicated on HB 1736’s text message, the fresh Evergreen Condition has actually a projected 800,one hundred thousand people with pupil loans, having the typical personal debt of approximately $33,five hundred.

Brand new guarantee of a reduced-interest Arizona program id news that government education loan interest levels increases towards 2022-23 instructional season. Interest levels with the government loans provides ebbed and flowed from the early in the day pair instructional ages: Instance, money to have undergraduate pupils had a speeds of 5.05% throughout the 2018-19 instructional 12 months and you may 2.75% on the 2020-21 instructional 12 months.

Within 17, I thought college loans was in fact an investment, said Carla De- Lira, whom affirmed to own HB 1736 into Jan. 31. I did not completely understand new implications out-of taking out 10s regarding a large number of [bucks within the] funds.

Just how Washington’s brand new financing work

In the Massachusetts, such as, customers can access no focus student education loans that must definitely be paid off inside a great s provided with the National Fulfilling regarding County Legislatures. Georgia youngsters enrolled in the new nation’s college or university and technology college or university expertise, including those who work in private colleges, usually takes out fund having fixed rates of interest of just one%.

We heard reports over and over about precisely how debt is actually overburdening youngsters, and it’s for you personally to do something about it, Agent Sullivan said for the a statement. Given that county are unable to cancel government education loan loans, we could offer expect youngsters in order to accessibility a college degree without taking up crushing, high-notice debt one to throws such things as home ownership out of reach once they graduate.

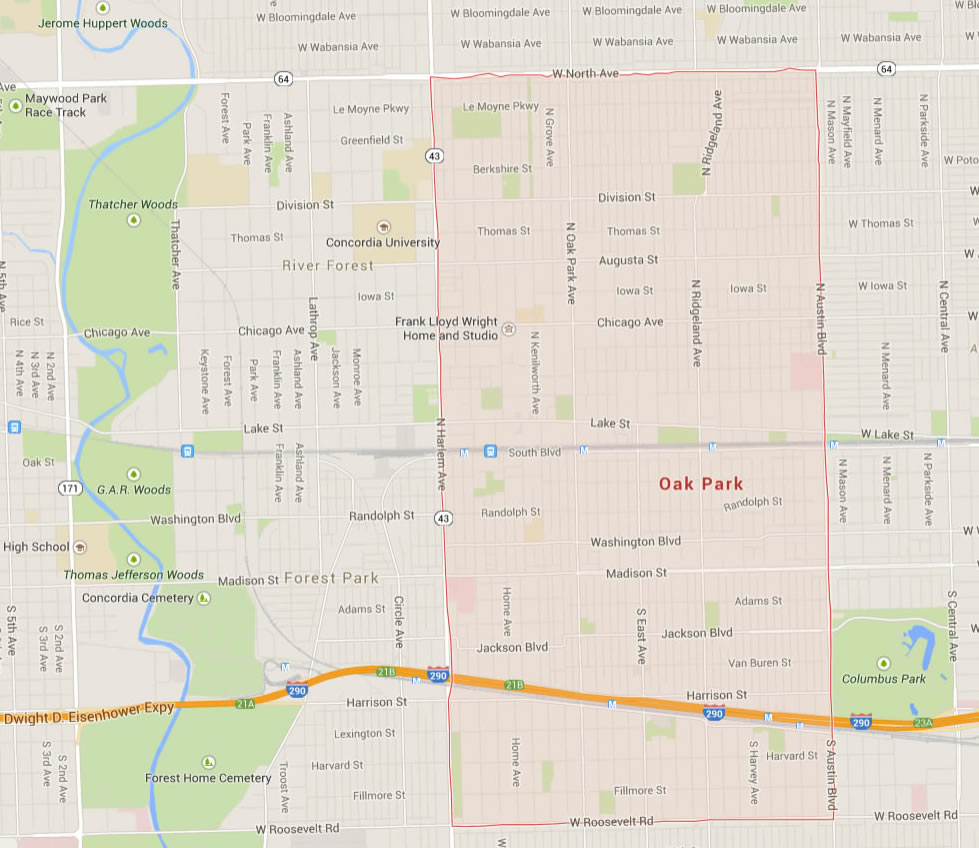

Residents regarding Washington, with among the lower pricing away from owning a home inside the nation, have experienced average home values increase out-of $223,900 last year in order to $452,eight hundred inside the 2020.

Washington lawmakers propose to pay for the program having a single-time deposit from $150 million (previous versions of one’s statutes lined up having more substantial financing out-of $300 billion so you can $five hundred mil). The latest Washington Pupil Completion Council will need to price that have an actuary to research the plan, and whether or not the system are self-preserving toward money paid down at the step one% attract.

It really makes sense for me that you have an ensured 1% price, that’s it, Sullivan told you. You aren’t in the whim out of long lasting [national] offers at the time.

The latest council is also tasked which have making sure establishments focus on these the fresh state funds for particular groups, and first-age group people and the ones felt lower income.

Individuals have been 18 in order to 39 years old and you may defined as first-age group college students had been probably be than their counterparts to fall about to the financing money, considering analysis on Government Set-aside, which also understood Black and you can Hispanic individuals (age 18 to 39) due to the fact disproportionately likely to be trailing on the obligations.

Arizona Republicans choose

The balance was read in the house College and you can Employees Innovation Committee, and also in the fresh new chamber’s Appropriations Committee. Associate. Kelly Compartments, R-Puyallup, just who is into the one another, voted resistant to the proposition, preferring to help with methods one to place cash in mans pouches therefore capable work on the houses.

Nowadays, with rising prices, having have strings circumstances, which have cost during the Washington, we have been merely watching the brand new fit to your typical, working family members when you look at the Arizona, she said in the an interview which have Crosscut.

Spaces indexed your county makes latest assets within the highest knowledge. In the 2019, legislators passed new Associates Knowledge Money Work, a costs meant to create college or university cheaper for lower-income children.

Several GOP legislators, Agent. Skyler Rude, R-Walla Walla, and you can Associate. Joel Kretz, R-Wauconda, broke using their associates to help you vote yes on bill. Impolite felt attention a serious challenge when you look at the man’s operate to spend down their finance – an issue the guy knows in person given that people with scholar loans.

It is really not step 1%, I am able to let you know that, said Rude, whom expectations to see a shift to the zero- otherwise reasonable-interest finance.

The new affiliate in addition to got a part of brand new publishing of bill, as he americash loans Paint Rock put a modification to ensure the program including covers college students likely to separate colleges regarding the state.

What is actually remaining to find out

Components of the application form was basically upwards in the air whenever HB 1736 passed, also its finally interest, loan constraints and also the shipment between undergraduate and you may graduate people.

Undergraduates exactly who meet up with the program’s conditions meet the criteria, if you are graduate students should be seeking a specialized arena of data which is experience a staff lack or even in popular.

This altered when he read graduate youngsters describe the primary financial aid it receive comes in the type of money, that’ll in the near future possess large interest rates: If you are undergraduates should expect observe the pricing go up so you can 4.99% for paid and you will unsubsidized financing, scholar people can find the speed into the unsubsidized fund boost so you’re able to six.54%.

Reanne Chilton, a scholar beginner getting an effective doctorate into the medical psychology from the Arizona County College, affirmed and only HB 1736 on the ily to track down an excellent college degree, revealed being required to trust state and federal assistance to shell out on her behalf degree given that the lady household members couldn’t financially service the woman education.

In her own testimony Chilton discussed lowering a deal to pursue a graduate education from inside the knowledge, thinking she couldn’t pay for they. She fundamentally decided to remain her education, and therefore implied tilting with the student education loans during the the lady scholar job to help you purchase expenditures like books.

During the a perfect community, all youngsters could see school devoid of to adopt one obligations, Sullivan said. Student education loans are part of our system. That’s the facts and you will, if it’s, following let us create about more workable.

Brand new Washington Student Achievement Council is needed to are accountable to Gov. Inslee together with Legislature because of the , as well as the construction, durability and execution.